Personal Finance Education: A Crucial Yet Overlooked Requirement in High Schools

December 10, 2024 - 04:19

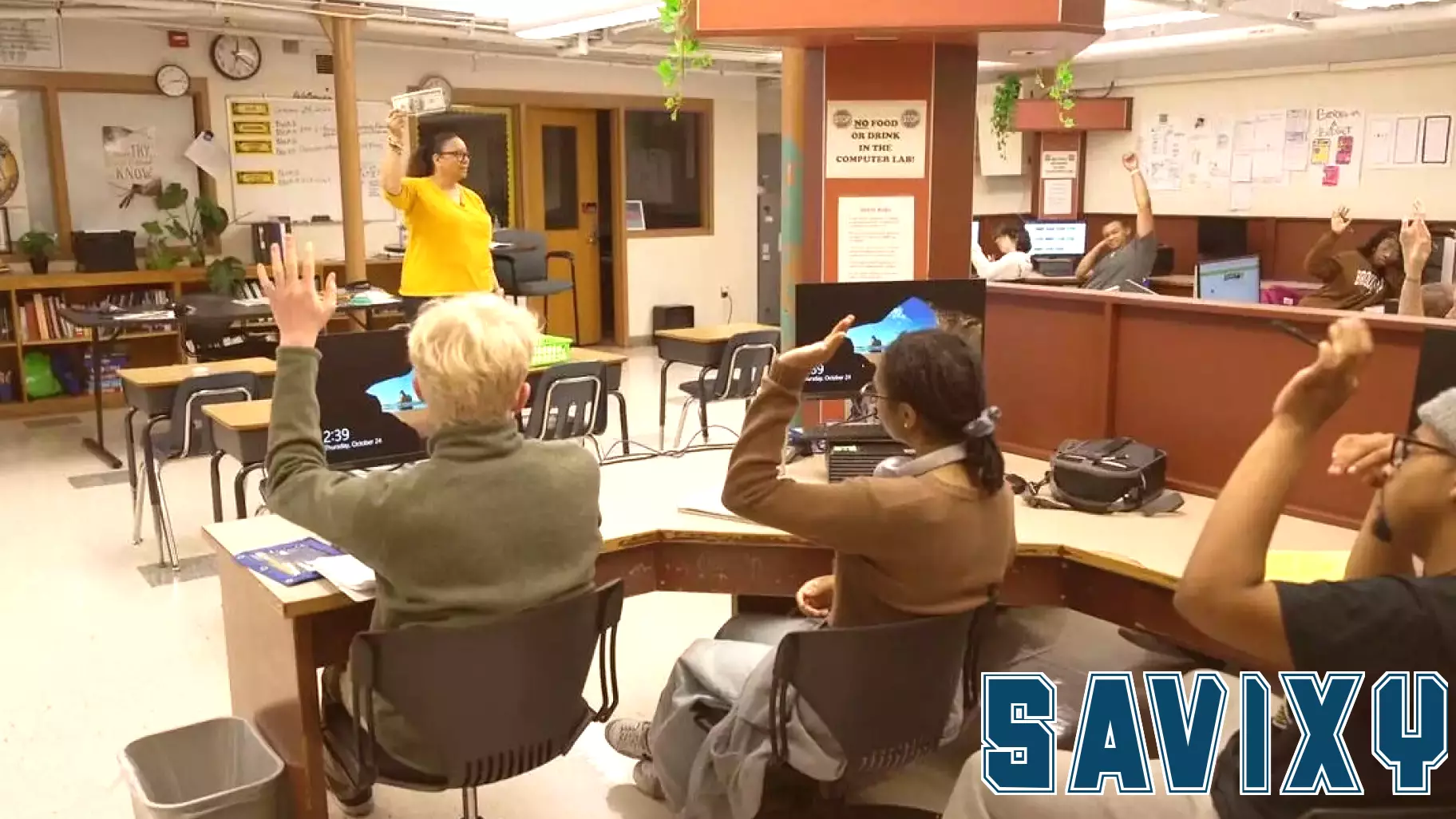

Despite a growing interest among high school students in financial literacy, only 10 states mandate personal finance courses as part of their curriculum. This gap in educational requirements has raised concerns among educators and parents alike, particularly as young adults face increasingly complex financial decisions upon graduation.

One passionate teacher emphasizes the significance of financial education, asserting that it is the most vital course students will encounter during their high school years. Many students express a desire to learn about budgeting, saving, investing, and managing debt, recognizing that these skills are essential for their future success. The lack of standardized financial education across the country leaves many students unprepared to navigate the financial realities of adulthood.

Advocates for personal finance education argue that it should be a fundamental component of the high school curriculum, equipping students with the necessary tools to make informed financial decisions. As discussions around financial literacy continue, the hope is that more states will recognize the importance of this subject and implement required courses for all high school students.

MORE NEWS

March 10, 2026 - 04:37

Anthropic sues DOD as feud with Trump administration escalatesThe escalating conflict between artificial intelligence company Anthropic and the federal government has entered a new phase. The AI safety and research firm filed a federal lawsuit against the...

March 9, 2026 - 05:21

The war on fraud is really a war on the poorThe United States has long organized its anti-poverty programs around one overriding assumption: that poor people are likely to cheat. This foundational belief has shaped a system where the pursuit...

March 8, 2026 - 01:06

METEC Resource Center reports financial irregularities to policeThe Peoria Police Department has opened an investigation into financial irregularities reported by the METEC Resource Center, a community-focused non-profit organization. According to the agency`s...

March 7, 2026 - 02:47

Why The Univest Financial (UVSP) Story Is Shifting After New Price Target And AssumptionsFinancial analysts have issued an updated assessment of Univest Financial Corporation, raising their price target by two dollars. This revision places the model`s fair value estimate at $36.00 per...